Summary

SmartFee provides a solution for accounts to offer fee funding to their clients. It allows their clients to split their fees into several periodic payments to improve their overall cashflow.

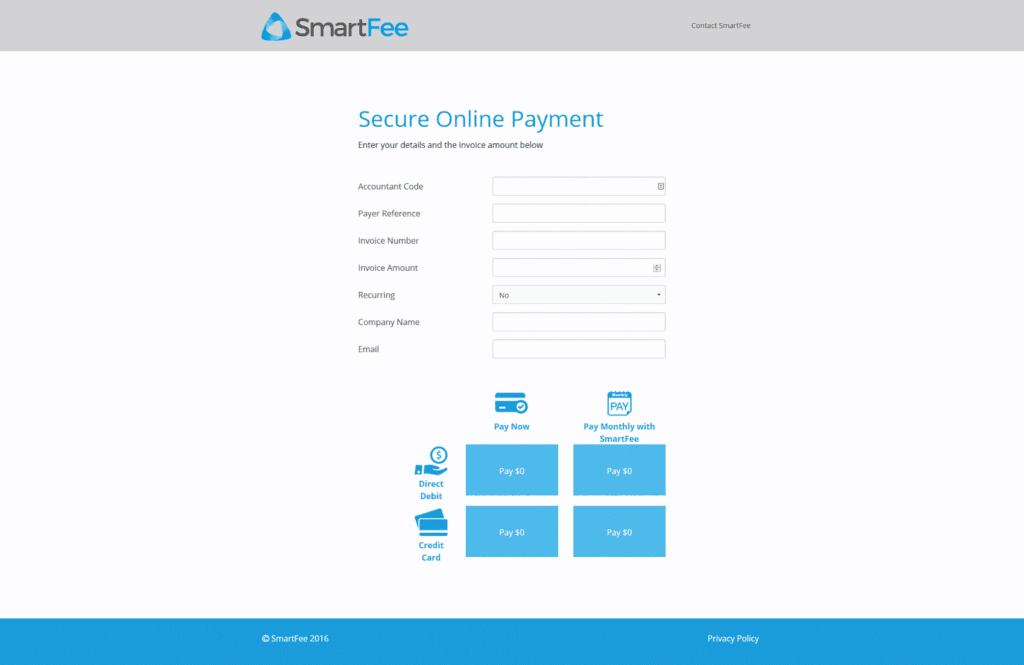

Aktura Technology was engaged to develop a portal where accountants could direct their clients to sign up for instant payments or loans, using either direct debit or credit card payments.

Features

- Communicates with several API systems for various payment options

- Admin area for SmartFee to create accountant profiles

- Branding modified on the fly to show accountant’s info and logo

- Pre-filled information based on links embedded into invoices

- Repayment calculations

Client

Name: SmartFee

Industry: Accounting

Location: Brisbane, Australia

Size: 5 staff

Details

SmartFee used tried and tested third party APIs to implement most of the required functionality. As the application was to be used by people with varying computer usage capabilities, a simple and intuitive user interface was developed with most of the heavy lifting hidden behind the scenes.

Using customized URL links embedded in an email, accountants refer their clients to the payment portal which pre-fills most of the data and displays the accountants branding to the client. The client is presented 4 payment options. Credit card fees and loan repayment calculations were applied to display the payment amounts for:

- Pay now via credit card

- Pay now via direct debit

- Instalments via credit card

- Instalments via direct debit

The client is presented with a form tailored to their payment method. No credit card data could pass through SmartFee’s server as this would require PCI compliance, a very costly process. Instead, data was sent directly to the processors systems, which passed back the payment result.

As the client required a prototype of the application within a very short amount of time, we were able to borrow from our existing code bank and reuse a considerable amount of existing code, reducing development time by around 100 hours.

Feedback

Screenshots

Technology

- Ruby on Rails

- JSON APIs

- XML APIs

- Pre built back-end for cost savings

Challenges

- Credit card data could not pass through server so as to require PCI compliance

- Rushed development schedule

- Existing infrastructure for hosting